Comprehensive Financial Services

The Social Equity Group offers various financial services tailored to your unique needs and goals. From personalized money management to community investing, our team is here to assist you in making informed decisions. We help with:

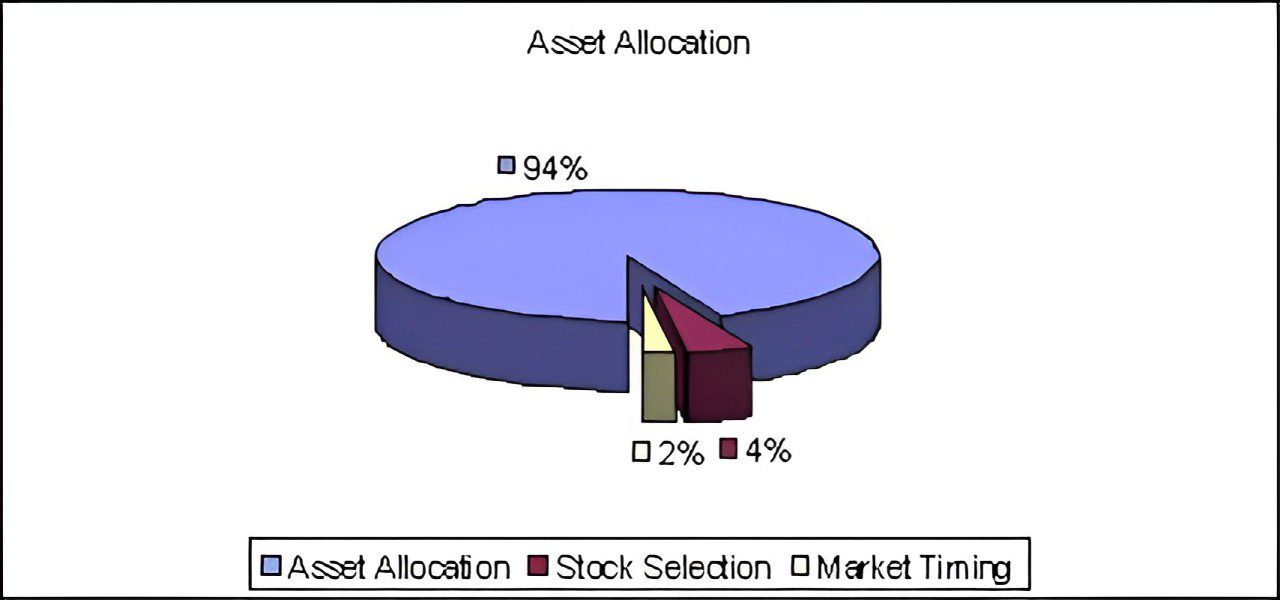

Asset Allocation

Asset allocation involves spreading your investments across different asset classes to maximize returns while minimizing risks. This risk versus return equation must be balanced against your personal investment situation. It is at the center of what is known as Modern Portfolio Theory (MPT), the creator of which is the winner of the Nobel Prize in Economics.

Asset Classes

There are many asset classes to choose from, ranging from the conservative (cash and bonds) to the moderate (large cap, REITS, and medium cap stocks) to the more aggressive (small cap and international stocks). Each class delivers a particular mix of risk versus reward. For example, cash asset allocation offers minimal investment risk but little potential investment upside or protection against inflation.

On the other hand, stocks have historically delivered much better returns over the long term. For example, from 1925 to 2005, large company stocks delivered a compound annual return of 10.4%, whereas long-term government bonds returned 5.5% for the same period. Cash equivalents, like T-Bills, delivered a compounded annual return of only 3.7%, barely more than the inflation rate.

Personalized Money Management

The Social Equity Group offers socially responsible personalized money management (PMM). Our highly customized portfolio management is for clients with $250,000 or more to invest. This ensures adequate diversification and helps minimize long-term risk. For accounts with less than $250,000, please get in touch with us for a personal consultation on the best choices for your investment strategy.

What Is PMM?

Personalized money management is for investors who prefer continuous, professional supervision and management. It is a win-win strategy! Our fees can only go up if your portfolio increases in value. We sit together on the same side of the table throughout the investment process.

Fee Structure

Personalized money management (PMM) accounts are subject to a different fee structure than brokerage mutual fund accounts. Though a brokerage mutual fund account may be subject to commissions for each transaction or a fund’s sales load, a PMM account will incur an annual fee even if there are no transactions. Further, for investors who elect no-load mutual funds and are willing to monitor and manage their portfolios, the cost of a PMM portfolio may be higher.

Financial Services for Businesses

The Social Equity Group works with businesses of all sizes to “green” your finances. We offer the following services for business owners:

Cash Management Accounts:

- Competitive Yields

- Total Liquidity

- Tax-Free Choices

Retirement Plans:

- Complimentary Review of Your Current Plan

- Socially Responsible and Traditional Choices

- SEP and SIMPLE IRAs

- Regular and Roth 401(k) and 403(b) Plans

Advice for Employees:

- Traditional, Roth, and Rollover IRAs

- College Funding – 529 Plans, Educational IRAs

- Tax-Free and Tax-Credit Investing

- Customized Money Management

Financial Services for Non-Profit Organizations

The Social Equity Group has a long history of working with non-profits and engaging in progressive action for social change. We understand the unique financial needs of non-profits.

Too often, organizations with progressive missions fail to apply the same standards to where their money goes. The Social Equity Group can help your group “walk the talk.”

- Socially responsible 401(k) and 403(b) plans that are affordable

- Professional advice for employees on financial and retirement planning, asset allocation, and personal investing

- Cash management accounts with total liquidity, competitive yields, and professional management.

Contact us for a complimentary plan review!

Retirement Planning

Retirement today is more than just a matter of accumulating enough money. At The Social Equity Group, we can help you make intelligent decisions to insure yourself against financial hardship during your working life, choose appropriate retirement accounts if you are employed or self-employed, and select investments that reflect your risk tolerance. We can also help you navigate the delicate balance between saving for retirement and addressing college tuition costs.

We can help you calculate the financial requirements for your dream retirement and identify which resources you have available to pay for it.

Risk Management

The Social Equity Group can help you determine the best, most cost-effective insurance for the different stages of your life. As part of our financial services, we help you choose the right mix of insurance and ensure you only purchase what you need.

Education Saving

Tuition costs have risen faster than inflation rates, between four and eight percent yearly. An average annual increase would push a $16,000 annual tuition bill to more than $33,000 in 15 years. Numerous tax breaks and college savings options, including new 529 plans, have emerged recently to help make college more affordable for many families. We can help you evaluate and select the best strategies for your situation.

One of the biggest questions many parents raise is how to save for their children’s college education without sacrificing their retirement security. As part of our financial services, we can help you determine acceptable trade-offs.

We Can Help You Answer These Questions:

- When should I start saving for college?

- How much do I need to save each month?

- What are my investment choices?

- Should I save in my child’s name?

- What can I do when there is little time to save?

- How can I learn more about financial aid?

For most families, a college education is a goal worth the financial effort. We can help families provide a good, affordable education for their children.

Charitable Giving

Our financial service experts can assist you with the following:

- Contributions to the charity or non-profit organization of your choice

- Charitable Gift Annuities: The donor contributes and receives tax deductions and lifetime monthly income.

- Donor Advised Funds: An investment designating the income or principal to a non-profit organization.

- Charitable Remainder Trusts: Funds are put into a trust with monthly income for the trustee and distributed to non-profits upon the donor’s death.

Community Investing and Tax Credits

Investors who wish to be more proactive or require tax relief can invest in low-income housing tax credits, community development banks or loan funds, and venture capital offerings.

By participating in these programs, you have a direct impact on the quality of life for the entire community. At The Social Equity Group, socially responsible investing serves the financial interests of the investor and the community.